- HOME

-

Markets

Trading Accounts

Account Types -

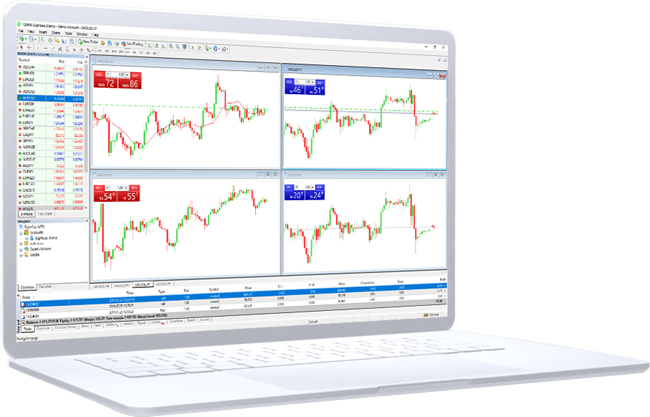

Platforms

MetaTrader

MetaTrader 4 -

About

Client Support

Contact Us - +64 800 443 693

-

HOME

Markets

Forex Trading Commodities IndicesPlatforms

MetaTrader 4About

Why Westfield Who we are Contact Us