- HOME

-

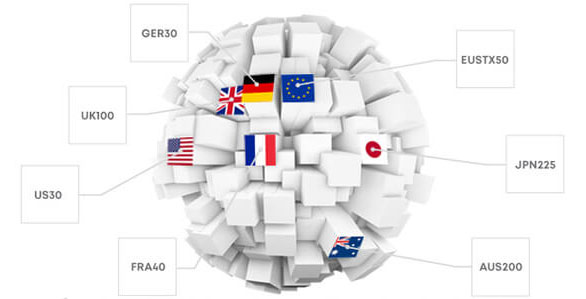

Markets

Trading Accounts

Account Types -

Platforms

MetaTrader

MetaTrader 4 -

About

Client Support

Contact Us - +64 800 443 693

Trade on MT4 across webtrader, desktop and mobile, all on our powerful and secure technology infrastructure.

› Trade US Shares, HK Shares and ETFs.

› Mobile & Desktop

› Award-winning platform

› Instruments in 9 time-frames

› 30 pre-installed indicators

You can use a variety of tools to trade, and trade US stocks, Hong Kong stocks, bonds, ETFs and other products in one account.

ETFs (Exchange Traded Funds) are ideal for long-term investors. They are used as a cost-effective method of owning all the index fund shares without buying each individual stock.

For active traders and traders with smaller capital, you can trade US stocks with minimal trading volume and enjoy the lowest commission of 0.